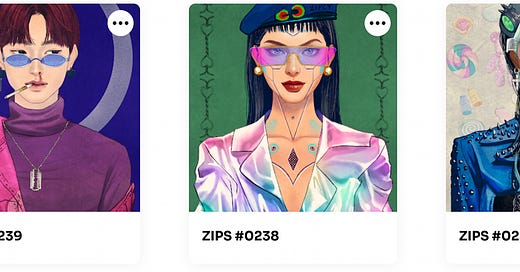

This week’s featured collection is SuperNormal

SuperNormal is a thought-provoking, authentic, and detailed exploration into the nuances of what it means to be extraordinary. Consisting of over 1000 traits, these 8,888 Generative NFTs on the Ethereum blockchain represent individualism by portraying elements of the diverse and unique. Check out some of the SuperNormal collection at lazy.com/supernormal

There is a popular phrase in NFTs that is often repeated: “DYOR” or “Do Your Own Research.” The point of the phrase is to remind you to thoroughly understand a project, and the risks entailed, before spending your money. This is, of course, great advice but when you’re new to collecting NFTs it can be hard to know what risks to avoid.

This week we’re going to help you DYOR by spotlighting three NFT risks that you should always look out for.

1) Is the project a rug pull?

If you’re thinking of collecting a new NFT from a project that hasn’t been around for long, the most obvious concern is the risk of a “rug pull”—the crypto colloquialism for when a project raises funds and suddenly disappears. Sadly, there are many examples of seemingly exciting new NFT projects that turned out to be sophisticated rug pulls. After raising hundreds of thousands of dollars, the project’s website is deleted and all funds are gone.

How to spot a potential rug pull? Zachxbt, a crypto sleuth, recommends watching out for the following: “The common theme between all of these [rug pull] projects are Fiverr art, fake engagement, high mint prices, & sketchy teams.”

In other words, ask yourself: Is the art exceptional? Is the community engaged and real? Is the team legit? Are the mint prices reasonable?

2) Is the project’s artwork permanently stored?

Imagine collecting an NFT, storing it in your wallet and then, when you check on it in a year, discovering that the image doesn’t load. This is, unfortunately, quite possible. That’s because some NFT projects store their collection’s images on basic web servers that can disappear or crash. Even the common practice of using IPFS is not a guarantee that the NFTs imagery will be permanently available. Some projects, such as Hashmasks, have turned to storing their imagery on Arweave to ensure it is permanently archived.

If you are doing your own research, be sure to ask whether the NFT project can guarantee their imagery will always be accessible.

3) Is the project’s copyright and licensing future-proof?

It is now common for NFT projects to promise their collectors full commercial rights to the NFTs they own. This, however, raises many legal questions that have not been resolved by the courts. (For a detailed analysis of NFTs and copyright, check out this article: “Copyright Vulnerabilities in NFTs.”) For most collectors, copyright will not be a major concern. However, there are two times in which it could be crucial:

Are you collecting an NFT that is dependent on a licensing deal? For example, F1 Delta Time, an NFT project that was launched in 2019 and officially licensed by Formula One, collapsed last month because the creators were unable to renew the licensing deal. This rendered the NFTs worthless. Read more about that saga here.

Do you plan to sell rights to an NFT you own? If you’re collecting an NFT with the goal of profiting from the commercial rights then you need to do extra research.

We hope these three questions help you DYOR. As always, stay safe and be cautious!

👉🏼 Want to make an impact on the NFT scene? Here’s your chance: Lazy.com is hiring a web3 front-end developer with React experience. Tens of thousands of collectors use Lazy.com to display their NFTs. Shape what they see. Apply now by sending a sample of your work. 👀

We ❤️ Feedback

We would love to hear from you as we continue to build out new features for Lazy! Love the site? Have an idea on how we can improve it? Drop us a line at info@lazy.com