Newsletter #41

An advanced strategy for NFT collectors

This week we are going to explore an advanced strategy for earning a profit from your NFT collection.

The most straightforward strategy for making money from NFTs is the classic “buy low, sell high.” Put simply, collectors hunt for undervalued projects and speculate on their price appreciation. However, the downside of this strategy is that a collector must take on the risk of cool hunting projects (what if they are wrong?) and they must be willing to sell their artworks (what if the NFT will be worth substantially more in the future?).

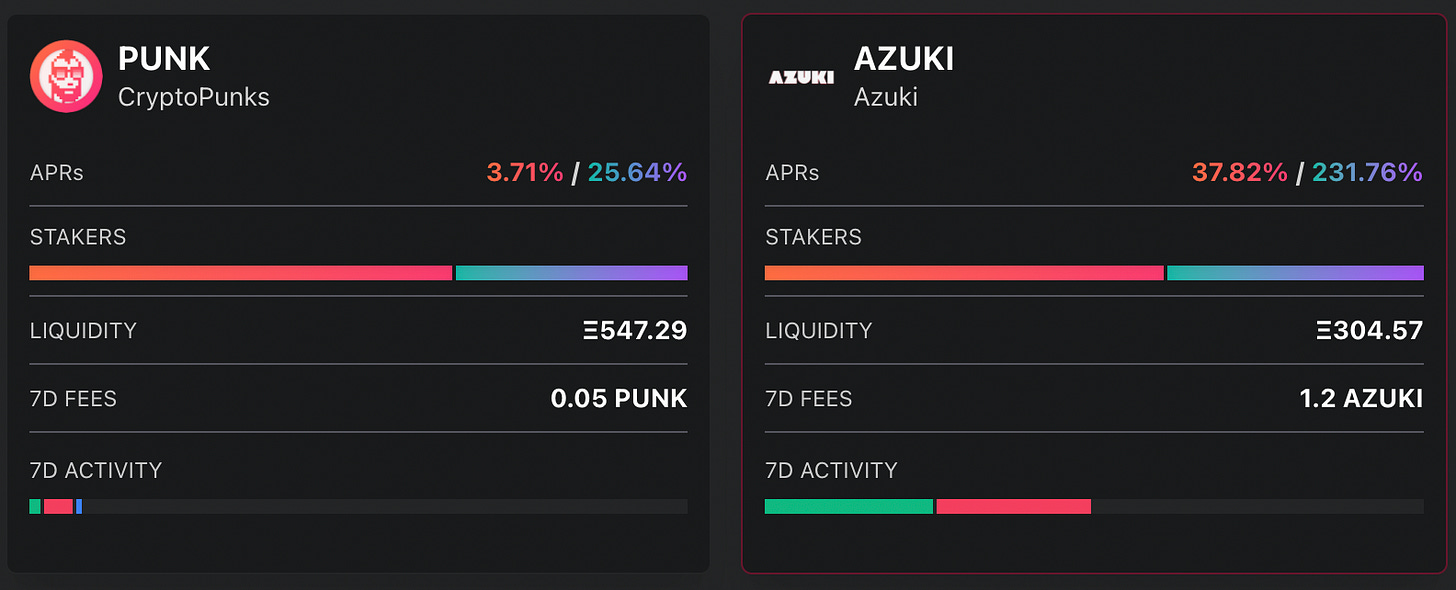

Today, we’re going to explore a different strategy for profiting from an NFT collection. This strategy is known as Inventory Staking and it recently became possible thanks to an update from NFTX.io.

Here’s how it works:

A collector acquires a few of the cheapest NFTs from a well-regarded project.

These “floor NFTs” are then deposited into NFTX.io’s new Inventory Staking.

The collector now earns a share of revenue from the buying/selling that occurs in their pool.

The collector can withdraw an equal number of NFTs from the pool when they unstake.

In other words, using the terminology of DeFi, this is single-sided staking without impermanent loss.

The obvious benefit for collectors is that they can earn passive income on their collection without having to sell. The downside is that, although the collector will receive the same number of NFTs back, they may not receive the identical NFTs that they staked. That’s why it is important to only deposit floor NFTs.

As in all things crypto, be sure to understand what you’re doing before you attempt to use this advanced strategy.

In the future, we will explore more NFT strategies. Until then, happy collecting!

We ❤️ Feedback

We would love to hear from you as we continue to build out new features for Lazy! Love the site? Have an idea on how we can improve it? Drop us a line at info@lazy.com